So, you're budgeting and our thinking, is floss HSA eligible? No, dental floss and similar over-the-counter products are not eligible for HSA reimbursement. That said, there is more factors to consider.

In this article, we will cover how to use an HSA for dental care, which dental expenses are covered, and which are not. We'll also explore orthodontic expenses, general-use items, and important considerations.

Let's jump in!

What this article covers:- How Do I Use An HSA for Dental Care?

- What Dental Expenses Are Covered by HSA?

- What Dental Expenses Are Not Covered By HSA?

- HSAs and Your Orthodontic Expenses

- What Are Considered General Use Expenses?

- What to Consider Before Using HSA for Dental Expenses

How Do I Use an HSA for Dental Care?

Many patients ask "is flossing necessary?" While dental professionals unanimously agree it is, using a Health Savings Account (HSA) for dental care can help manage the out-of-pocket costs.

To use your HSA for dental care, the expenses must qualify under IRS guidelines, including medically necessary treatments. Always check with your HSA provider to confirm that the service qualifies for reimbursement.

For an easy and efficient way to clean between teeth and maintain gum health, try SNOW's Water Flosser. With three customizable modes, it's perfect for sensitive gums and effective at removing plaque.

What Dental Expenses Are Covered by HSA?

Our research indicates that HSAs can be used for a wide range of dental services. Eligible expenses typically include cleanings, X-rays, fillings, root canals, and gum treatments. More extensive procedures like crowns, dentures, and wisdom teeth removal are also covered if medically necessary.

Orthodontic treatments like braces or Invisalign are covered if they address a medical need. If your dentist prescribes these treatments for functional reasons, HSA funds can be used. But be sure to obtain a letter of medical necessity.

Complement your dental care routine with SNOW's Activated Charcoal Whitening Floss, which helps remove plaque and stains while detoxifying your mouth with peppermint and activated charcoal.

What Dental Expenses Are Not Covered by HSA?

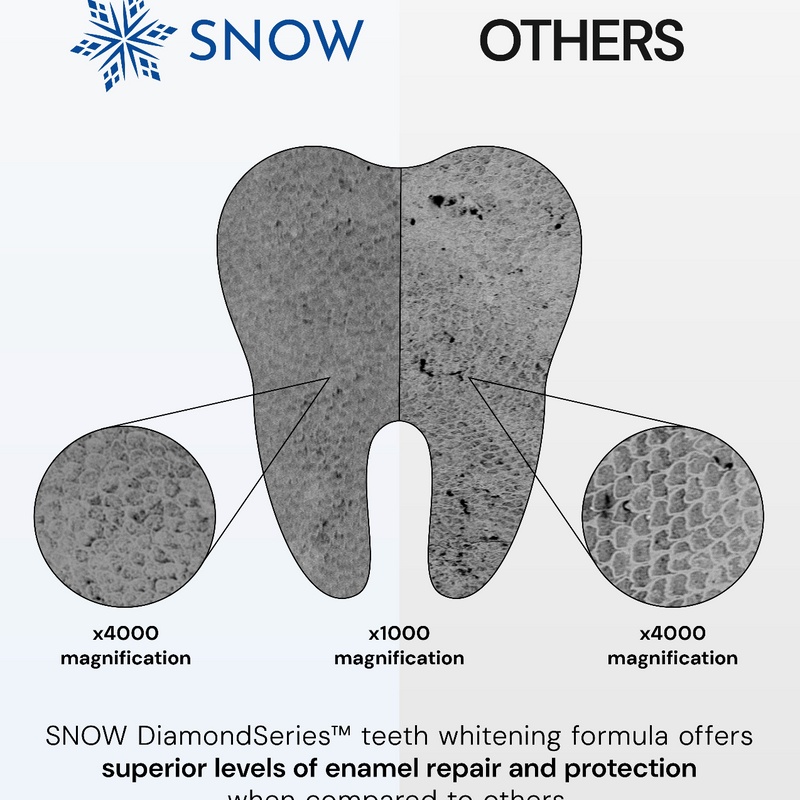

HSAs do not cover cosmetic or unnecessary dental procedures. For example, teeth whitening treatments done purely for cosmetic purposes are not eligible.

Based on our observations, cosmetic dental work like veneers and dental implants generally won't qualify unless there's a functional need.

Everyday dental items like toothbrushes, toothpaste, and floss are not covered under HSA guidelines. These essential oral hygiene items fall under general health products and do not meet the criteria for eligibility.

For a convenient and eco-friendly flossing option, SNOW's Charcoal Whitening Floss Picks us activated charcoal to help remove surface stains. Recent studies exploring "is flossing good for your heart?" have shown promising connections between oral and cardiovascular health. So, start your habit today!

HSAs and Your Orthodontic Expenses

Our findings show that HSAs can help cover the costs of orthodontic treatments such as braces or clear aligners if deemed medically necessary by a dentist. Correcting a misaligned bite that could lead to future complications is considered a valid use of HSA funds.

Patients often wonder "is mouthwash better than flossing?" when considering their oral care routine. Both are important. That's why we recommend incorporating SNOW's Arctic Frost teeth whitening mouthwash into your daily routine to maintain a bright smile while enjoying a refreshing, alcohol-free clean.

What Are Considered General Use Expenses?

General use expenses include routine check-ups, cleanings, and medically necessary treatments. Cavity fillings, gum disease management, and root canals are eligible expenses as they prevent more serious conditions.

Prevention is the best medicine. Try SNOW's teeth whitening toothpaste, which strengthens enamel and provides gentle whitening so you can visit the dentist less often!

What to Consider Before Using HSA for Dental Expenses

Before using your HSA for dental expenses, understand the eligibility requirements. Ensure the dental procedure is considered medically necessary by your dentist.

Plan ahead for major dental expenses like orthodontics or oral surgeries. Contributing to your HSA before these costs arise can help maximize tax benefits.

Always keep receipts and documentation to support any claims, as your provider may request proof of eligibility.

Upgrade your oral hygiene routine with SNOW's Advanced Whitening Electric Toothbrush. With sonic technology and LED lights, it enhances plaque removal and helps achieve a whiter smile.

Conclusion

Now you know that everyday items like floss and toothbrushes do not qualify for HSA reimbursement. However, many necessary dental treatments can be covered.

We've discussed the dental expenses covered by HSAs, like preventative care and medically necessary treatments, and those that are not. Orthodontic expenses can also be covered under an HSA when prescribed for health reasons.

For those looking to improve their dental health, visit SNOW, where we offer safe and effective kits suitable for those with sensitive teeth!

If you want to learn more, why not check out these articles below:

- Is Flossing More Important Than Brushing

- Is It Too Late to Start Flossing

- Is Waxed or Unwaxed Floss Better

- Should You Floss Twice a Day?

- Should I Floss in the Morning?

- Should You Floss Every Day?

- Should You Floss After Every Meal

- What Happens If You Don't Floss?

- What Is Floss Made of?

- What Are the Benefits of Flossing

- What Is Floss?

- Does Floss Expire

- Does Flossing Whiten Teeth

- Does Flossing Create Gaps in Teeth

- Does Not Flossing Cause Bad Breath